SUMMARY:

- It’s been 16 months

- We’ve opened 8 new credit cards

- Received $6,565 in signup bonuses and rewards travel

- We paid $457 in membership fees so far

- A whopping $149,000 in total available credit lines

- Starting credit score = 764

- Current credit score = 810

I’ve been taking notes every time I applied for a new card or learned something interesting. So I thought it might be helpful to publish my notes and timeline.

I first got interested in credit card hacking when I read this article from Waffles on Wednesday. These guys travel more than anyone else I know, and are very smart about collecting the best rewards.

At first I was skeptical, worried about my credit score, and too lazy to try it myself. But early last year I got my act together and applied for my first rewards card. 2018 was going to be a big travel year for my wife and I, and we wanted any & all travel bonuses/incentives we could get.

WARNING:

First, an important note… Consumer debt in the US is a very serious problem. Opening new credit cards to buy things that you can’t afford is a horrible plan. If you are currently in credit card debt, cannot responsibly handle credit, don’t have attention to detail, or have only a loose understanding of your personal finance goals, credit card hacking is not for you. It’s like playing with fire while your hands are soaking in petrol. Don’t do it.

STARTING OUT:

Before applying for any new credit cards, I wanted to learn everything there is to know about the upsides, downsides, risks, processes, etc… I started with this 10,000 word post, written for beginners. This is part of a larger Reddit forum on credit card hacking (aka “Churning”), and there’s an answer to almost any question here.

After feeling comfortable, I started applying for cards based on the highest incentives first. I was very careful not to apply for too many at once, only opening cards with minimum spending requirements I knew I could hit easily. Looking back, I was probably too conservative, but it’s better to be safe than sorry!

This flowchart here was very helpful:

WHAT WAS I WORRIED ABOUT?:

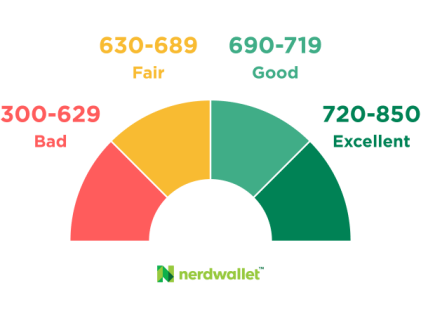

Credit Score Concerns: My biggest concern of credit card hacking was the effect on my credit score. I closely monitored my credit score through the past 18 months and something cool happened… My credit rating went from excellent, down to excellent, moved up to excellent, and then back down to excellent. There was a 50-60 point swing in both directions, but I never left the “excellent zone”.

Credit Score Concerns: My biggest concern of credit card hacking was the effect on my credit score. I closely monitored my credit score through the past 18 months and something cool happened… My credit rating went from excellent, down to excellent, moved up to excellent, and then back down to excellent. There was a 50-60 point swing in both directions, but I never left the “excellent zone”.

Relationship with Chase Bank: Chase is my primary bank, and a few of the mortgages for my rental properties are with them. The last thing I wanted to do is piss off my banking partner by abusing their credit card programs. To date (knock on wood) I have had no issues, and am slowing down on opening new cards.

Earning Points for Nothing: What’s the point of earning incentives if you never use them? My wife and I solved this concern by only apply for cards that give us rewards we will actually use. (Hotels mostly as we travel a lot). Starting with Chase UR points was smart as they are very flexible for any type of reward spending.

Lying on Applications, Manufactured Spending, & Being Denied Credit: Many people out there use ‘loopholes’ or little white lies to accelerate earning benefits. My wife and I were never comfortable with this, we took the legal and conservative approach to make sure we didn’t get into any trouble.

CARD TALLY:

| Card Name | Date Opened | Points Type | Bonus? | Annual Fee | Minimum Spend |

| Chase Sapphire Preferred (Wife) | Feb 2018 (Cancelled) | Chase UR | 50,000, +5k for add user | $95, waived first yr | $4000, 90 days |

| Chase Sapphire Preferred (Joel) | Feb 2018 | Chase UR | 50,000, +5k for add user, +10k for referral | $95, waived first yr | $4000, 90 days |

| IHG Rewards Card – OLD | 2012 Existing | IHG Rewards | 50,000 IHG points | $49, not waived | N/A – old |

| Chase Bus Preferred INK (LLC) | April 2018 (Cancelled) | Chase UR | 80,000 + 20k in-branch signup with manager, +5k add wife as user | $95, not waived | $5000, 90 days |

| IHG Elite (Joel) | July 2018 (Cancelled) | IHG | 80,000 IHG, +5k for add user | $89, not waived | $2000, 90 days |

| Chase Bus Preferred INK (Wife Bus) | Oct 2018 | Chase UR | 80,000, +20k referrals, +5k add user | $95, not waived | $5,000, 90 days |

| SouthWest Premiere (Joel) | Feb 2019 | SW Rapid Rewards | 40,000 SW points | $79, not waived | $1000, 90 days |

| SouthWest Business (LLC) | Feb 2019 | SW Rapid Rewards | 60,000 SW points | $99, not waived | $3000, 90 days |

| Capital One Venture (Joel) | June 2019 | Cap One Venture | 50,000 | $95, waived first yr | $3000, 90 days |

TIMELINE AND NOTES:

Feb 23, 2018:

Just signed up for Chase Sapphire Preferred (Wife personal name). We have a bill coming up for rental prop #4 property that will be over $4000, so first minimum spend is already met. 50k signup points, as well as another 5k to add Joel as authorized user on the account and make first purchase.

Notes:

- Husband and wife can not use the same Chase.com login, so we had to sign Wife up for Chase UR account online. (Points can be transferred later with no fee to do so, apparently)

- Read this online somewhere… I called -800-493-3319 and asked for expedited shipping. Cards arrived in 2 days. No charge to do so.

- Credit score per Experian is currently 764 (Joel)

Feb 28, 2018:

Signed up for another Chase Sapphire Preferred card, Joel’s personal name. We’ve hit the minimum spend for wife’s CSP already, it’s “put in the closet” labelled so I don’t forget which one it is. All new spending to start on this new card once received. Expedited shipping via calling customer service again.

Notes:

- Wife approved at $16,000 credit limit, and Joel approved at $32,000 limit. I don’t think this makes a difference but should prob keep track of overall credit lines.

- No big bills coming up so we’ll have to put every expense on the new CSP cards over the next 3 months to meet the $4k limit.

- Insurance on rental properties is due early-mid year. Possibility to pay early and directly, even though insurance is escrowed? Not sure, have to check with Chase and Ins company.

- Answer is YES for paying annual property insurance. If you ‘overpay’ the insurance company will return a check to you.

April 1st, 2018

Just signed up for Chase Business Preferred INK card for our business LLC. Signed up in-store, referred to the branch manager and was told we’d get an extra 20k points, so 100,000 total. Downsides of business card include minimum spend is $5000 for 90 days (starts the day you get approved – not activate the card) and $95 fee is not waived for the first year.

Notes:

- Asked for expedited shipping, no cost to do so.

- Added spouse (set up as ‘employee’ under LLC) for 2nd card. This needed to be done after receiving the initial card. Expedite shipping at no cost.

- Limit approved at $25,000.

- Although under a business name, they pulled a ‘hard’ credit check with my personal SSN to get this card. No big deal given my good credit score, but this might take a beating soon.

- LLC has its own Chase.com login so this is a pain in the ass. But, can transfer points to my personal account as same last name and home/business address.

April 14th, 2018

Referred Sister to Business Preferred INK. Referral Bonus should be 20,000 points when she gets approved. She signed up as soon as I sent her the referral. (8/1/2017 Never signed up?? Check with Sis, no credit received)

- Credit Score Check: Credit actually went UP! In March my credit score showed a 764, now it shows a 791. I realize opening new lines of credit and total amount of credit is not the only factor in calculating your credit score, but I would have thought my credit would have taken a hit. Keep checking each month.

April 23rd, 2018

Earlier in March I paid one of my rental properties Insurance bill online, even though Chase Escrow pays for Insurance and taxes. This helped meet minimum spend but caused other issues.

Notes:

- Chase Escrow also paid my insurance, so my direct payment was technically “overpay”

- Not a huge deal, Insurance company sent me a letter and refund check quickly.

- Check was made out to the Insured parties. (Not additionally Insured on policy, or to the lien holder.) All good, deposited no issues.

July 14th, 2018

Applied and approved for IHG Elite Card. 80,000 points under Joel’s name.

Notes:

- Current credit score via Experian is 795

- Called IHG card services, having trouble expediting card and sending to Montana address where we are traveling.

- Eventually got authorization to ship new cards to our temporary address in Montana. Note, keep calling and insisting, as managers can solve more problems in customer support (be nice about it).

- Need to meet $2,000 spend in 90 days. Already met $1k for Geico car insurance x2 and a few grocery trips here. Need to plan next card.

- Future planned spending is wife’s flights to Australia, although we have enough points to cover this too.? Chat to wife about options.

August 17th, 2018

Looks like credit score took a huge hit. Currently sitting at 745.

September 11th, 2018

Sent referral link today to Brother → should be 10,000 points, as just CSP personal card. Interested in credit card hacking so future referrals may be possible too.

September 17th, 2018

Credit score is back up to 767 (up 22 points since Aug 17th)

October 20th, 2018

Signed up for Chase Business Preferred INK via Wife SSN for side business. This will be our travel card for Australia trip. Used my own referral code from LLC card to get bonus (20k) and the signup for card should be $80,000 when approved.

November 19th, 2018

Took a long time for approval of wife’s business card. Didn’t need to call Chase, they advised by mail.

Notes:

- Met min spend already with flights and wedding activities in Aus. 80k points received.

- Received 20k referral points for referring ourselves to ourself!

- Received 10k referral points for referring wife’s Mom who got approved.

- Credit score back up to 802

Jan 30th, 2019:

Applied for new SW Premier personal card in Joel’s name. Plan is to shoot for SW companion pass with Personal and Business card combined –> The golden goose of credit card hacking.

Notes:

- Application under review. Called support but they say the application is under review and we have to wait.

- Credit score dropped to a 760 for all December but now it’s back up to 803. Huge 40 point swing!?

- Min spend hit same week as only $1k

Feb 13th, 2019:

Applied for SW Business Card under LLC. Application pending.

Notes:

- Letter received in mail → Approved and got cards in the mail. It also came with a letter saying they automatically decreased the limits on my other Chase cards because I hit the maximum credit line with Chase based on my income. Reduced some of the credit line on my other personal accounts to achieve credit line on new card.

- Credit score sitting at 799

Feb 20th, 2019:

Already hit minimum spend for personal SW card. Paid Rental Properties Insurance bill for ~$1500 for rental property #2

Called 1-800-543-9719 to discuss SW Business card and application status. Live rep answered and did a questionnaire on my income and total credit line etc.

- Bus Card was approved over phone and should be here in 7-10 days. Didn’t show up in my Chase account online so I’ll need to figure out what to do to add it there.

- Credit score 802

Feb 28th, 2019:

Received new business card in the mail. Called Chase at 800-432-3117 to consolidate the business logins for these accounts. Called and cancelled Wife’s personal Chase Sapphire card.

Mar 17th, 2019:

Called and cancelled LLC Business INK card. $0 balance and zero points balance as transferred to personal UR Login.

- No objections to cancel on phone. Easy process.

- Credit score at 814

May 18th, 2019:

Received SW Companion Pass!

Received SW Companion Pass!

- Booked free flights to Vegas

- Booked free flights to New Orleans

- Still have 80k points left, Hawaii trip?

June 18th, 2019:

Applied for Capital One Venture Card online.

- 50,000 points after $3000 spend in 3 months

- Called 1-800-227-4825 to expedite card, BUT, apparently they have no expedite process for this. They said it’ll take 14 days to ship me a new card. Also, I have to wait until the arrival of the new card before activating a second user on the account. Booo.

- Credit score at 810

June 26th, 2019:

Received new card in mail. Activated, and ordered card for wife. Expedited at no cost, will arrive via FEDEX in 2-3 days.

July 9th, 2019:

- Cancelled IHG Premier as $89 membership fee will be due in a couple days.

- Still have old IHG card active with $49 membership fee (has more or less the same benefits as the other card and free annual night etc…)

- Chase asked if I wanted to transfer my credit limit to another card but I declined, only $5k difference. Slowing down on credit card hacking, especially with Chase cards even though wife under 5/24

- Credit score still 810

Good deal you’re so smart!! A lot to keep track of and very interesting.

Way to go, Joel and Mack.

Impressive summary of all your credit card activity. I like how you tracked your credit score through all of the moves you made. I got us a few cards back in 2017 and am looking to get back in the game next year, when the Chase 5/24 rule shouldn’t be an issue.

Question for you on the business cards, any thoughts on what a minimum revenue should be before applying for one?

Dragon Guy

Cheers! For the business cards, the application asks what your “expected” revenue is for the current year. Since the businesses I created had little-no revenue, I just put $10k or $20k as a guesstimate.